All Categories

Featured

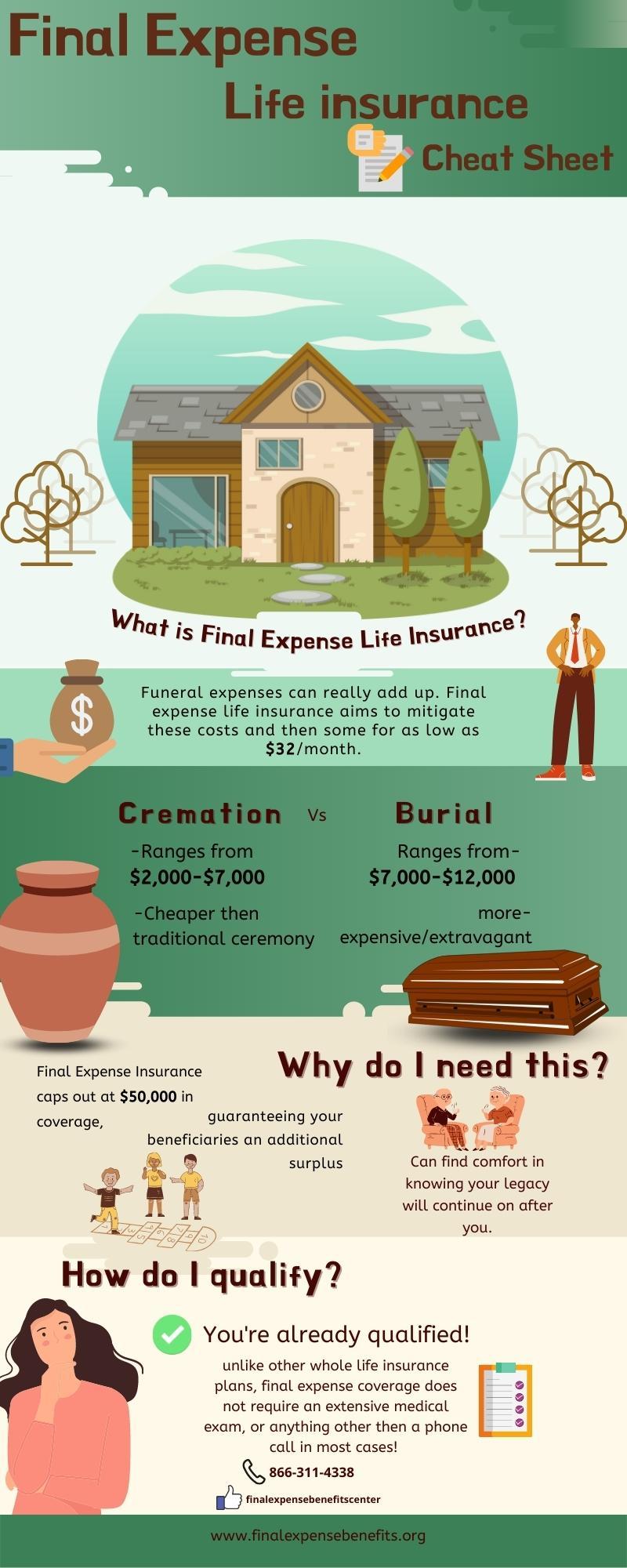

On top of that, clients for this sort of strategy might have severe legal or criminal histories. It is essential to keep in mind that various carriers use a series of concern ages on their guaranteed issue plans as reduced as age 40 or as high as age 80 - final expense insurance market. Some will also supply higher face worths, approximately $40,000, and others will permit much better survivor benefit conditions by enhancing the interest rate with the return of costs or decreasing the number of years up until a full survivor benefit is available

Latest Posts

Funeral Plan Broker

Published Mar 02, 25

9 min read

Sell Burial Insurance

Published Feb 24, 25

9 min read

Bereavement Insurance

Published Feb 23, 25

6 min read